The South Koreans gather around actions based on Ethereum

South Korean retail investors sell their major technological actions such as Tesla and Alphabet in favor of the actions linked to Ethereum, the Korea Economic Daily reported, citing data from the back-up values.

Tesla has long been an element in the first classification of net buyers for Korean retail investors, but it was sold during the last month with around 1 Wons Billion ($ 721.6 million) in net sales. Alphabet and Apple were also strongly sold, with net sales of around 230 billion won ($ 166 million) and 300 billion won ($ 216 million), respectively.

These retail investors are locally called “SEOHAK ants”. SEOHAK results in “Western learning”, but in the interior finance jargon, it refers to investors in foreign equities. “Ants” is a local nickname for retail investors, referring to their small size but a large number compared to institutional whales.

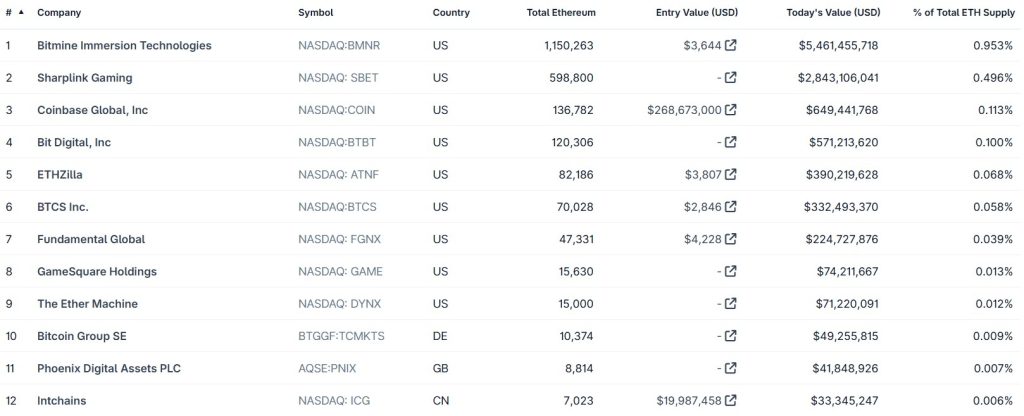

According to the Korea Securities values deposit, these ants have invested $ 269 million in the last month in Bitmin, a Bitcoin Mining and Ethereum treasure company which is now the largest ETH holder.

Excluding the funds negotiated on the stock market, half of the seven main actions of net purchase by ants during this period were companies related to cryptocurrency: Coinbase, Robinhood and Sharplink Gaming, the second largest holder of the ETH.

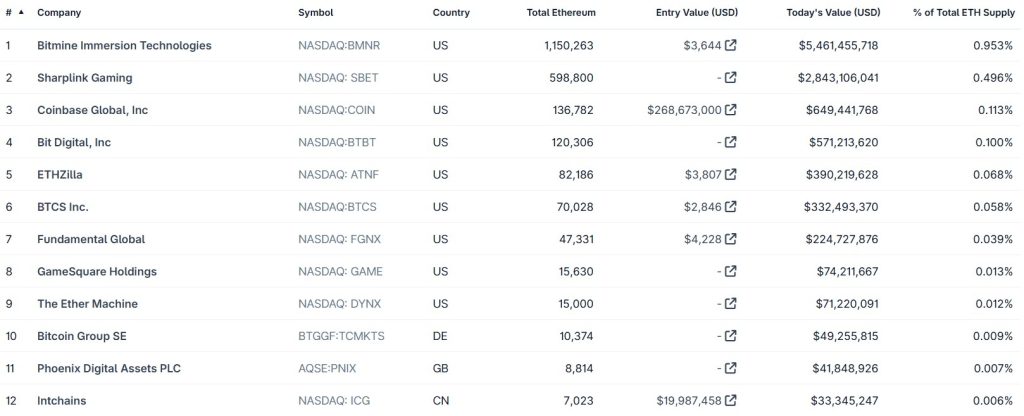

The value of Ethereum’s assets by public companies has recently increased, inspired by the success of Bitcoin cash companies – a play book popularized by Michael Saylor and Microstrategy. BTC or ETH hold was not only beneficial for companies due to the appreciation of cryptocurrencies, but also increased their share of shares. At the time of writing the editorial staff, 18 public companies collectively hold 1.88% of Ethereum’s offer, according to Coigecko data.

Bank supported by the state of Vietnam to launch on Crypto Exchange

A bank founded by the Ministry of Defense of Vietnam intends to launch its own exchange of cryptocurrency.

Military Bank (MB Bank) has signed a memorandum of understanding with Dunamu, the operator of the UPbit cryptocurrency exchange, to access the infrastructure, technology and compliance of technology and company regulation to establish its own exchange.

MB Bank, founded under the Ministry of National Defense of Vietnam in 1994, claims to be the fifth largest bank in the country with a total asset of around 50 billion dollars.

In case of success, it could become the first exchange of regulated cryptography in Vietnam, and intervenes while Vietnam prepares the nation for a crypto push during a global boom in crypto regulations. In June, the Vietnam National Assembly adopted a law that brings cryptocurrencies under regulatory surveillance.

The law on digital technology industry has essentially legalized cryptocurrencies by legally recognizing two classifications: virtual assets and cryptographic assets.

Read

Features

Should you “children with orange pill”? Bitcoin children’s books

Features

Extinct or existing: can blockchain preserve the heritage of endangered populations?

Thai crypto companies catch errors in the “mule account”.

Cryptocurrency companies in Thailand will share responsibility if their non-compliance with official standards leads to customer damage.

The Thai Securities and Exchange Commission (SEC) has deployed binding rules that put the exchanges of cryptocurrency and other digital asset companies on the saddle in a national repression of “mule accounts” – formerly legitimate financial accounts which have been rented or sold for use in scams and money laundering.

As part of the new executive, which entered into force on Wednesday, cryptographic companies must carry out checks of your customers and share customer data with the police. If a mule account is identified, cryptographic platforms must freeze them or refuse services.

The new rules create a “shared responsibility” scheme in which financial institutions, payment providers, telecommunications companies, social media platforms and crypto companies can be held jointly responsible for customer losses if they neglect to comply with the standards prescribed by the SEC to prevent technological crime.

The SEC said that Crypto Mule accounts have become a favorite tool for crooks because they are more difficult to trace than bank accounts. Between March and late June, the authorities 29,000 Crypto Mule accounts were frozen in Thailand, worth 186 million baht (around $ 5.7 million).

People who rent or sell mules accounts can incur up to three years in prison or up to 300,000 baht.

The watchdog added that anyone rents or allows you to use your account for technological crime can incur up to three years in prison, a fine of up to 300,000 baht, or both.

Read

Features

Polkadot’s Indy 500 driver, Conor Daly: “My father is dowry, how crazy is it?”

Features

Could a financial crisis end the crypto bull?

Ant Group denies having established a stablecoin partnership with the Central Bank

Chinese technology giants continue to repel speculations that they plan to issue a stablecoin to the Yuan.

Rumors circulating on social networks and in some media have suggested that China could prepare to approve a stablecoin in Pius. The authorities have not confirmed such plans.

The interest in Stablecoins has intensified following the deployment of new Hong Kong Stablecoin regulations, which allow companies to request a license. Chinese electronic commerce giant JD.com is among the candidates and was also pushed to refuse allegations that he had already launched one.

Ant Group is the last major technological company to grow against similar rumors. The company rejected information that it had established a partnership with the Banque Populaire de China and the Group of Rare Chinese Terres to create a stable RMB supported by the Rare Earth.

“Ant Group has never had a plan of this type with the institutions mentioned,” he said in an article on social networks on Monday.

The enthusiasm of the stable in China is very high, with researchers and academics – including those of the main state -based institutions – publish recommendations and studies on the potential advantages of stablecoins. The regulators have intervened in recent weeks, urging the internal market to stop publications and research seminars on the subject.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.