The best stories of the week

Banking giants now provide at least two interest rate drops in 2025

Several financial institutions and market analysts are currently planning the American federal reserve, the country’s central bank, will reduce interest rates from the current target rate of 4.25% to 4.5% at least twice in 2025.

Banking forecasts followed a low August employment report which only experienced 22,000 jobs added for the month, against expectations of around 75,000.

Analysts from Bank of America, a banking and financial services company, have reversed their long -standing position without rate reduction in 2025 and now project two 25 -point reductions (BPS) – one in September and another in December – according to Bloomberg.

Economists of the investment bank company Goldman Sachs project three 25 -point reductions in 2025, from September and continued in October and November.

Trump Media concludes the Crypto.com agreement to build $ 6.4 billion Cro Treasury

Trump Media & Technology Group, the parent company of the American social platform of the American president Donald Trump, finalized an agreement with Crypto Exchange Crypto.com on Friday which establishes a new entity to accumulate the native cronos token, starting with a first purchase of 684.4 million CRO in the context of a joint strategy of the Treasture.

In a Friday notice Trump Media said he would buy tokens at a price of approximately $ 0.153 each, bringing the total initial purchase to almost $ 105 million. The transaction will be carried out as an exchange of equal origin and cash between companies.

The announcement follows Trump Media Group Cro Strategy, a joint venture established by Trump Media, Crypto.com and Yorkville Acquisition Corp., to establish a cryptographic treasure of $ 6.4 billion from the CRO token.

According to the company, the agreement will allow social users of truth to potentially acquire CRO on the platform as part of a reward program.

Justin Sun urges the WLFI linked to Trump to unlock “UnreasFrozen token ons

The founder of Tron, Justin Sun, urges World Liberty Financial (WLFI), a crypto project linked to the Trump family, to thaw his token allowance. His portfolios were put on black list after suspicious transactions reported by blockchain trackers have sparked charges of sale.

Sun’s WLFI’s Decon’s address was put on black list Thursday, after data from the Nansen and Arkham blockchain reported the address of a transfer of $ 9 million, Cointelegraph reported.

In a response from Friday to the black list, Sun said that his pre-sales tokens were “unreasonably frozen”, urging the team behind World Liberty Financial to unlock their investment, with regard to the principles of decentralized blockchain technology.

World Liberty’s decision to block his tokens is a violation of the rights and risks of investors “to harm wider confidence in financial freedom,” wrote Sun in a post X.

The media company linked to Trump Jr. projects $ 100 million

Thumzup, Thumzup, Linking Media Corporation from Trump, plans to acquire 3,500 Dogecoin extraction platforms and plans to bring up to $ 103 million in annual income, depending on whether Dogecoin strikes a dollar.

In a letter of shareholders published Thursday, Thumzup Media Corporation revealed that it had executed final agreements, pending the approval of the shareholders, to acquire a Dogecoin extraction operation with 2,500 initial platforms and 1,000 other orders.

In August, the company said that it went from an Adtech platform to the exploitation of cryptocurrencies thanks to the current acquisition of Dogehash Technologies, which operates the Dogecoin minors.

The combined company will be renamed Dogehash Technologies Holdings and will exchange under the XDOG Ticker. The company reported the completion of a stock offer of $ 50 million in August.

“ Avoidable errors ” suffered a year of texts from Gary Gensler… Oops

An investigation by the American Securities and Exchange commission (SEC) on the missing text messages of the phone’s phone, Gary Gensler, between October 2022 and September 2023, concluded that “avoidable errors” led to their loss.

The office of the Inspector General of the SEC (OIG) launched an investigation into the way in which nearly a year of text messages from Gary Gensler was permanent between October 2022 and September 2023, at the height of the Agency’s cryptography action campaign.

In a report published on Wednesday, the OIG revealed that the IT service of the dry “has implemented a poorly understood and automated policy which had caused an entrepreneurial of the mobile device issued by the Government of Peopleler”, which deleted stored text messages and newspapers of the operating system.

Read

Features

Banking the Unbanked? How I taught a total foreigner in Kenya on Bitcoin

Features

The `Deflation ” is a stupid way to approach tokenomic … and other sacred cows

The loss has been aggravated by poor change management, a lack of appropriate backups, ignored system alerts and faults in the software of unsolved suppliers.

Winners and losers

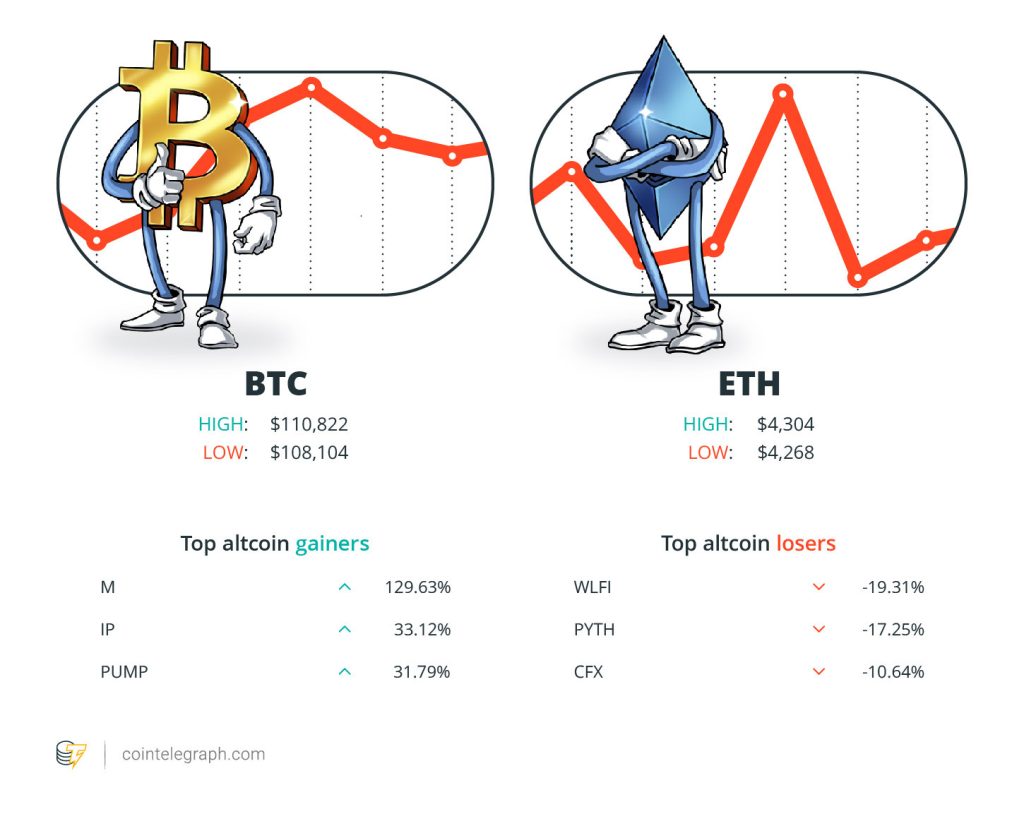

At the end of the week, Bitcoin (BTC)) is $ 110,822, Ether (Ethn)) at $ 4,304 and Xrp at $ 2.81. Total market capitalization is 3.81 billions of dollars, according to CoinmarketCap.

Among the 100 largest cryptocurrencies, the three main Altcoin winners of the week are even (M) at 129.63%, history (IP) at 33.12% and pump.fun (PUMP) at 31.79%.

The three main Altcoin losers of the week are World Liberty Financial (WLFI) At 19.31%, Pyth Network (Pyth) at 17.25% and conflux (Cfx) to 10.64%.

For more information on cryptography prices, be sure to read Cointelegraph market analysis.

Most memorable quotes

“What if, from now on, Bitcoin is slow and right, with long and accurate and accurate corrections and without incident of 10 to 30%?”

PlanBitcoin pseudonym analyst

“ETH will probably be 100x from here. Probably much more.”

Joseph LubinCEO and founder of consensys

“Pokémon and others (commercial card games) are about to have their” polymarket moment “.

Danny NelsonResearch analyst at Bitwise Asset Manager

“The only reason why we are not $ 150,000 at the moment is two massive whales.”

David BaileyCEO of Nakamoto Holdings

“It is a brutal reminder of the reasons why the crypto exists first of all: if an intermediary can unilaterally cut you with basic financial services for trying to create financial independence, the financial system itself is fundamentally broken.”

Jonathon MillerManaging Director, Australia in Kraken

“My opinion is that it is generally more prudent to focus on fundamental analysis rather than counting on what can often be parasitic historical patterns.”

Henrik AnderssonDirector of investments at Apollo Crypto

Superior prediction of the week

Bitmine buys $ 65 million from Eth while the President boasts “1971” for Ethereum

Wednesday, the Bitmine Tom Lee chair appeared on the Level up Podcast, where he reaffirmed his position according to which ETH will reach $ 60,000 in the long term.

Lee said Wall Street’s interest in ETH could become a “moment in 1971”, which could propel the active above. The New York stock market exploded on August 17, 1971, establishing volume and gain records, the president of the time, Richard Nixon, frozen wages and prices for 90 days, as well as other measures to fight inflation and strengthen the dollar.

“Wall Street that goes to crypto rails, I think, is like a moment in 1971 for Ethereum. So I think it creates enormous opportunities to move a lot on the blockchain. And Ethereum will not only be the only winner, but he is one of the main winners,” said Lee to Lee Level up The co-host David Grider.

Top Fud of the week

“ Too little railings ” warns Johnson de CFTC on the risks of the prediction market

The outgoing commissioner of the Commodity Futures Trading Commission (CFTC), Kristin N. Johnson, warned that the prediction markets pose growing risks for retail investors. She cited a lack of surveillance and regulatory clarity as the main concerns.

On Wednesday, in his speech, Johnson expressed his concern that certain market players offer market contracts with prediction to retail investors without clear regulatory borders.

“To date, we have too little railing and too little visibility in the landscape of the prediction market,” she said in a farewell speech to the Brookings Institution. “There is an urgent need for the Commission to express in a clear voice of our expectations related to these contracts,” she added.

Venus’ protocol recovers $ 13.5 million from the user stolen in phishing attack

The decentralized financial loan platform, Venus Protocol, helped a user to recover the stolen crypto following a phishing attack linked to the Lazare group in North Korea.

On Thursday, the Venus protocol announced that it had helped a user to recover $ 13.5 million in crypto after the phishing incident that occurred on Tuesday. At the time, the Venus protocol interrupted the platform as a precautionary measure and began to investigate.

According to Venus, the break interrupted the additional funds, while the audits confirmed that the smart contracts of Venus and the front-end were without compromise.

Read

Features

Investors “Raider” plunder Dao – names and Aragon sharing lessons learned

Features

How to make a metavese: secretary secrets

An emergency governance vote has enabled the forced liquidation of the attacker’s portfolio, allowing stolen tokens to be seized and sent to a recovery address.

Bitcoin Bear Market due in October with a target of $ 50,000: analysis

Bitcoin could only have a month before the end of a four -year cycle, triggering a collapse of $ 50,000.

The new comments of Joao Wedson, founder and CEO of Crypto Analytics Platform Alphractal, also include a price target of $ 140,000 in BTC.

Bitcoin faces a new calculation because the Haussier market continues its latest correction of 15% compared to the summits of all time.

In the middle of doubts about the future, Wedson sees the possibility of a new lowering market from early October.

By downloading graphics from his so-called “rehearsal fractal cycle” on X, he has shown that the BTC / USD is approaching when the bear markets historically take over.

Top Magazine Histories of the week

Chatgpt links to murder, suicide and “accidental jailbreaks”: AI EYE

Could ChatPPT behave less like a human the answer to AI psychosis? The more Geoffrey Hinton’s new solution to AGA alignment.

Korean bill to legalize the ICOs

Hong Kong regulators would have been skeptical about Bitcoin cash societies. The Chinese state company removes publications on Ethereum Rwas, and more.

Astrology could make you a better crypto trader: it was predicted

Can the monitoring of the movement of celestial bodies make you a better crypto trader? The answer can be yes, in some cases.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Editorial

The editors and journalists of Cintelelelegraph magazine contributed to this article.